A new book, The Heart of Finance, highlights the growing importance of emotional intelligence (EI) in the financial planning industry. Written by James Woodfall and Cliff Lansley, the book reveals how EI can significantly improve client relations, retention rates, and sales for financial planners, particularly in an era marked by economic uncertainty and technological disruption.

Financial planners regularly encounter complex emotions in their clients, from grief to fear and anxiety, as individuals navigate significant life events. Research conducted by Woodfall and Lansley has shown that financial professionals with high emotional intelligence, who can effectively manage and respond to these emotions, are more successful in building long-term, profitable client relationships.

Despite these findings, there remains a significant gap in global training programmes that teach EI to financial service professionals. The Heart of Finance aims to fill this void by offering a practical EI toolkit, based on cutting-edge scientific research, that can be applied directly to the financial planning profession. The book provides both theoretical insights and actionable steps, enabling financial planners to develop the EI skills necessary for effective client interactions.

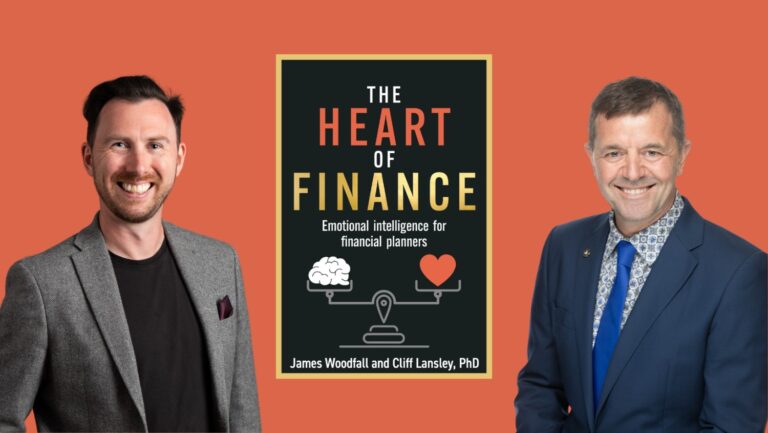

James Woodfall, a seasoned financial planner and founder of Raise Your EI, holds an MSc in Communication, Behaviour, and Credibility Analysis. He has spent years helping financial services firms use EI to enhance their business performance. Cliff Lansley, a director at the Emotional Intelligence Academy, is an expert on EI science, advising high-profile clients like Warner Bros. Discovery. He developed the EmotionIntell model, which underpins much of the training featured in the book.

The Heart of Finance guides financial professionals through the five key stages of the client journey: preparation for meetings, initial consultation, planning, implementation, and ongoing service. The authors present real-world scenarios, demonstrating how EI can be used to enhance communication and foster stronger relationships with clients. Key EI skills discussed in the book include identifying emotional triggers, adapting communication styles, and handling difficult conversations such as grief.

The book also tackles more advanced topics, including recognising vulnerability and dark traits in clients. Financial planners who are able to navigate these sensitive areas, rather than avoiding them, are more likely to achieve higher client retention and loyalty. The authors introduce frameworks such as the FORCED model and the Trusted Advisor method, which are designed to help planners build trust and create a safe space for deeper, more meaningful conversations with clients.

Ultimately, The Heart of Finance asserts that technical skills alone are not enough to succeed in financial planning. A financial adviser’s ability to adjust their communication style to align with clients’ emotions and triggers is what differentiates top performers from the rest. By mastering these emotional intelligence skills, planners can enhance their client relationships, leading to better business outcomes and a competitive edge in the marketplace.

The Heart of Finance is available for purchase on Amazon and in all leading bookshops.